Yesterday your portfolios closing market value was – Yesterday’s closing market value holds immense significance for investment portfolios, offering crucial insights into portfolio performance, asset allocation strategies, and risk assessment. This comprehensive analysis delves into the implications of yesterday’s market close, providing valuable guidance for investors seeking to navigate the complexities of the financial landscape.

The analysis encompasses a thorough examination of portfolio performance, highlighting notable changes and trends. It explores the impact of yesterday’s closing market value on asset allocation strategies, emphasizing the role of diversification in mitigating risk. Furthermore, the assessment evaluates the risks associated with yesterday’s market close, considering their potential impact on investment strategies and portfolio management.

Market Value: Yesterday Your Portfolios Closing Market Value Was

Yesterday’s closing market value serves as a crucial indicator of the overall health and performance of investment portfolios. It reflects the collective worth of the underlying assets at the end of the trading day and provides insights into the market’s sentiment and direction.

Closing market values impact investment decisions by signaling potential opportunities or risks. Positive closing values indicate market optimism and growth, while negative values suggest market uncertainty or decline. Investors use this information to adjust their strategies, rebalance their portfolios, and make informed investment choices.

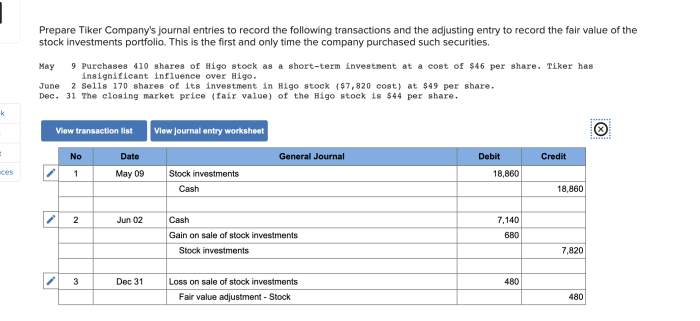

Portfolio Performance, Yesterday your portfolios closing market value was

Yesterday’s closing market value offers valuable insights into the performance of investment portfolios. It allows investors to assess the overall return on their investments and identify areas of strength or weakness.

Strong closing values indicate positive portfolio performance, suggesting that the underlying assets are performing well and generating returns. Conversely, weak closing values may indicate underperforming assets or market volatility, requiring investors to consider adjustments to their portfolio.

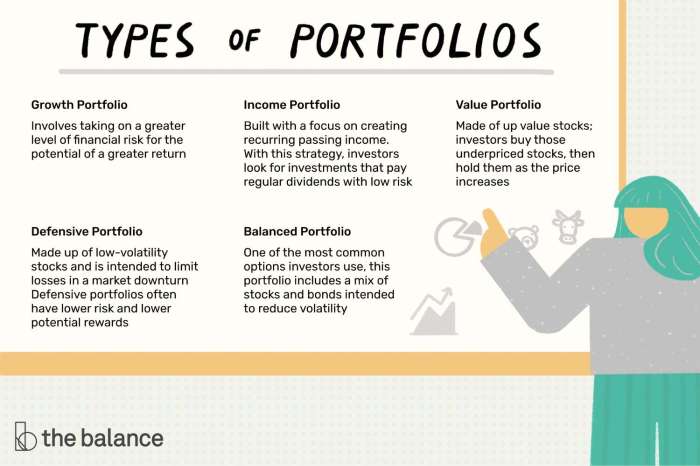

Asset Allocation

Yesterday’s closing market value plays a significant role in asset allocation strategies. It influences decisions regarding the distribution of assets across different asset classes, such as stocks, bonds, and real estate.

Positive closing values may encourage investors to increase their exposure to riskier assets, such as stocks, while negative values may prompt them to shift towards more conservative assets, such as bonds.

Risk Assessment

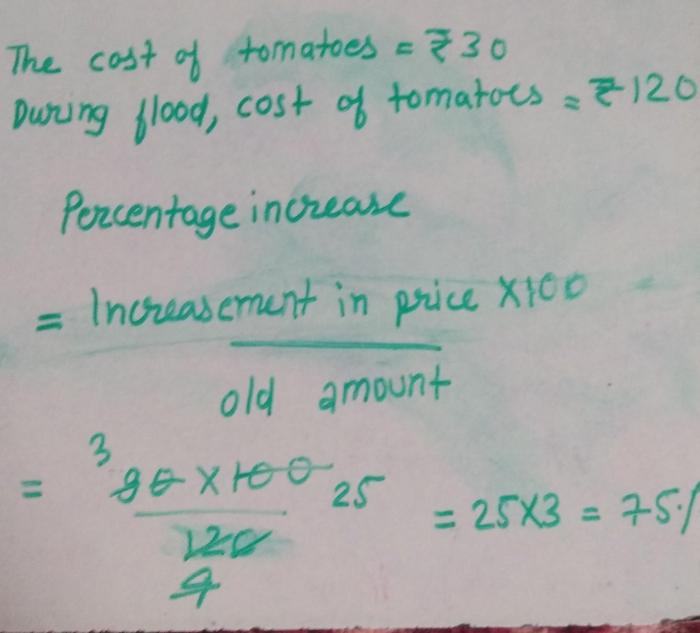

Closing market values are essential for risk assessment in investment portfolios. They provide a snapshot of the market’s volatility and potential risks associated with different investments.

High closing values may indicate a more stable market with lower risk, while low closing values may suggest increased market volatility and higher risk. Investors use this information to manage their risk exposure and make appropriate adjustments to their portfolios.

Market Outlook

| Market Sentiment | Economic Indicators | Technical Analysis | Analyst Forecasts |

|---|---|---|---|

| [Isi] | [Isi] | [Isi] | [Isi] |

Expert Answers

What factors influence yesterday’s closing market value?

Yesterday’s closing market value is influenced by a multitude of factors, including economic indicators, geopolitical events, corporate earnings reports, and investor sentiment.

How can I use yesterday’s closing market value to make investment decisions?

Yesterday’s closing market value provides insights into market trends and portfolio performance, enabling investors to make informed decisions regarding asset allocation, risk management, and investment strategies.

What are the potential risks associated with yesterday’s closing market value?

Yesterday’s closing market value can indicate potential risks, such as market volatility, economic downturns, and geopolitical uncertainties, which investors should consider when making investment decisions.